Business Insurance in and around Charleston

Charleston! Look no further for small business insurance.

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

Running a small business requires much from you. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, retailers and more!

Charleston! Look no further for small business insurance.

Almost 100 years of helping small businesses

Cover Your Business Assets

Your business thrives off your creativity tenacity, and having outstanding coverage with State Farm. While you make decisions for the future of your business and lead your employees, let State Farm do their part in supporting you with business owners policies, artisan and service contractors policies and worker’s compensation.

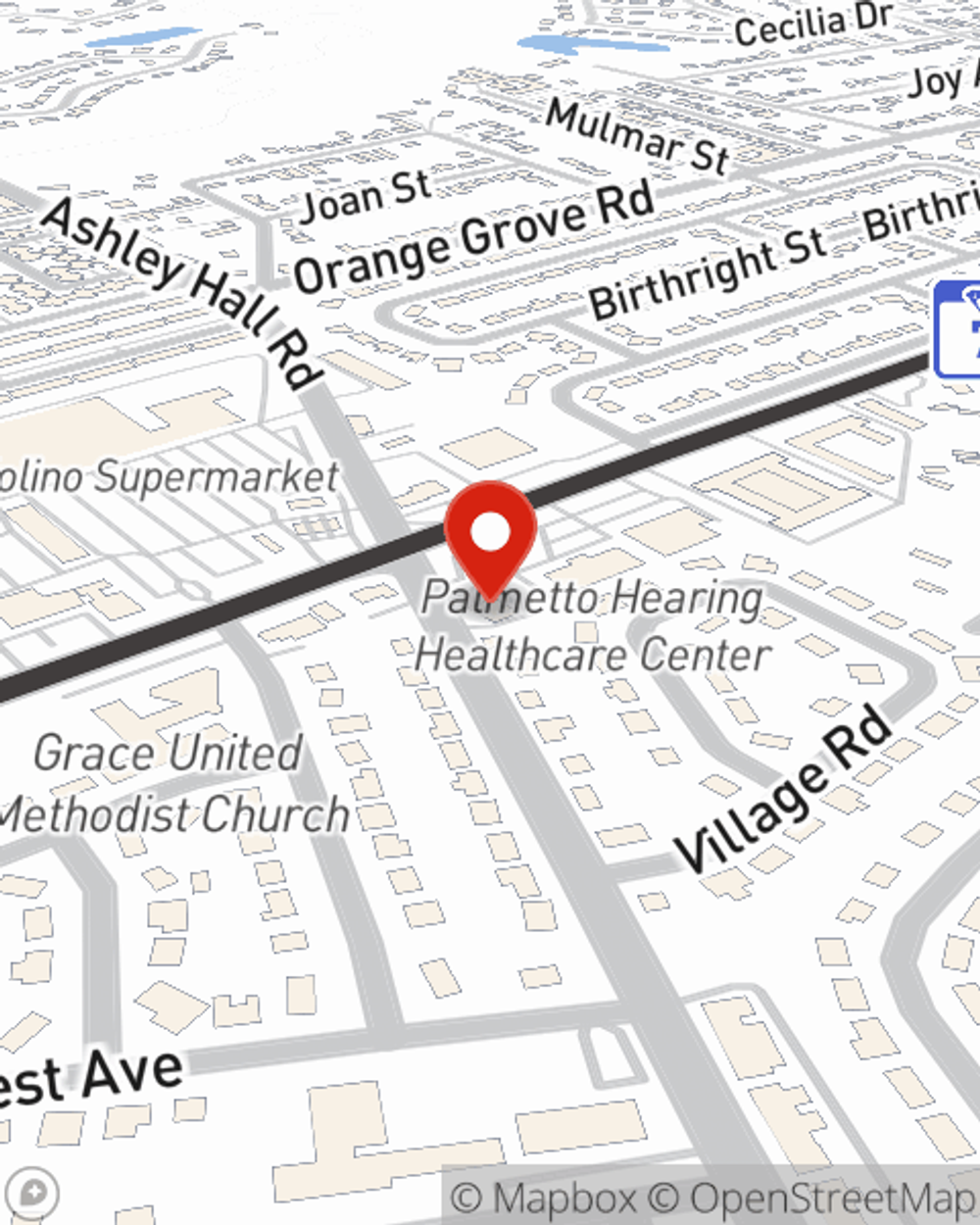

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Adam Pennington is here to help you identify your options. Call or email today!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Adam Pennington

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.